california tax fresh start program

Want to know if you qualify for the the Fresh Start Initiative. We have helped thousands of Americans over the last 36 years and can help you with your IRS and.

Irs Fresh Start Initiative A Guide To The Fresh Start Tax Program

We will listen to.

. Businesses - Offer in Compromise Booklet and Application for Business Entities 4905BE 7. Offer in Compromise Group MS A453. To request assistance please fill out a Fresh Start Request for Assistance form.

Loss of Income from 5 Years of Imprisonment 46KYear. A recent in-depth look at IRS data revealed a not-so-shocking truth. Individuals who have tax debt with more than 1 agency - Multi-Agency Form for Offer in Compromise DE 999CA 6.

Fresh Start Tax Relief strives to resolve your tax issues as quickly as possible with honesty and integrity. It is the best form of. Payments in the amount of 1000 to eligible California residents who elect to receive such payments.

Seizure of Your Home Equity CarsBusiness and Investments. The California Department of Tax and Fee Administration CDTFA would be. This IRS program offers a number of debt relief options to tax payers who fit specific financial requirements.

The IRS Fresh Start Program launched in 2011 is an initiative designed to make it easier for taxpayers to resolve tax debt by giving them a fresh start with the Internal Revenue Service. From my office in Roseville I represent clients in state and federal tax law resolution and collections matters throughout Northern. If so the IRS Fresh Start program for individual taxpayers and small businesses can help.

The Fresh Start Initiative Program provides tax relief to select taxpayers who owe money to the IRS. While conducting an extensive research on tax relief I spoke with Sam for hours and he was very. One of the biggest improvements in the IRS Fresh Start program is the increase in the IRS Notice of Federal Tax Lien filing threshold.

Office of the Public Defender E-mail. An IRS Fresh Start Program Offer in Compromise or OIC is an agreement that allows taxpayers to resolve their tax debt for less than the full amount they owe. In 2012 we eliminated a Civil Trust Fund Recovery Penalty on a payroll tax debt that ran into the tens of millions.

IRS tax liens may still be filed on back taxes below 10000 when needed however this change will help protect tens of. Instead the middle and upper classes shoulder the. Mail your application and all required documentation to.

Qualify for a Tax Relief with the IRS Fresh Start program. The IRS began Fresh Start in 2011 to help. The Trust Fund Penalty alone was over 9000000.

You may return the form through email fax mail or drop off at the address below. 16 rows Businesses impacted by recent California fires may qualify for. Our professionals are fully familiar with the program details.

This can be very. We understand how overwhelming tax issues and tax debt can be. My first thanks goes to Fresh Tax for resolving my IRS and California state tax debts.

My tax Settlement team has been helping people to take advantage of the full scope of the IRS Fresh start program for years. Roseville IRS Fresh Start Tax Installment Plan Lawyer. The IRS Fresh Start program is now well-known as a tax relief program that provides taxpayers with an opportunity to have their taxes adjusted and assessed by the IRS.

The IRS has increased the minimum liability for filing a tax lien from 5000 to 10000. We submitted a IRS Fresh Start Program for 300988 and still have the hand written note he sent us. California tax fresh start program.

Government in 2011The Fresh Start Initiative Program offers tax assistance to a certain. Are you struggling to pay your federal taxes. Designed to make life.

Office of the Public. The ultra-rich dont pay their fair share in taxes. The Fresh Start Program also known as the Fresh Start Initiative was established by the US.

The client paid the IRS 0 Zero Nothing.

5 Things To Know About The Irs Fresh Start Program Before You Start The Process Geaux Tax Resolutions

Tax Relief Company Tax Resolution Service

Notice Of Intent To Offset Overview What It Means What To Do

What Is The Irs Fresh Start Initiative Jackson Hewitt

Irs Debt Relief And Help Irvine Ca Landmark Tax Group

Help For O C Homeowners With Delinquent Property Taxes New Santa Ana

Irs Fresh Start Program San Diego Ca Global Gate Irs Tax Relief

Tax Debt Relief Services Stop The Irs Worry

Everything You Need To Know About Tax Relief In 2022 List Wire

New York State Back Taxes Find Out Tax Relief Programs Available

Irs Fresh Tax Settlement Service In California My Tax Settlement

Ca Ftb Tax Debt Forgiveness Settling California State Tax Debt Tax Resolution Professionals A Nationwide Tax Law Firm 888 515 4829

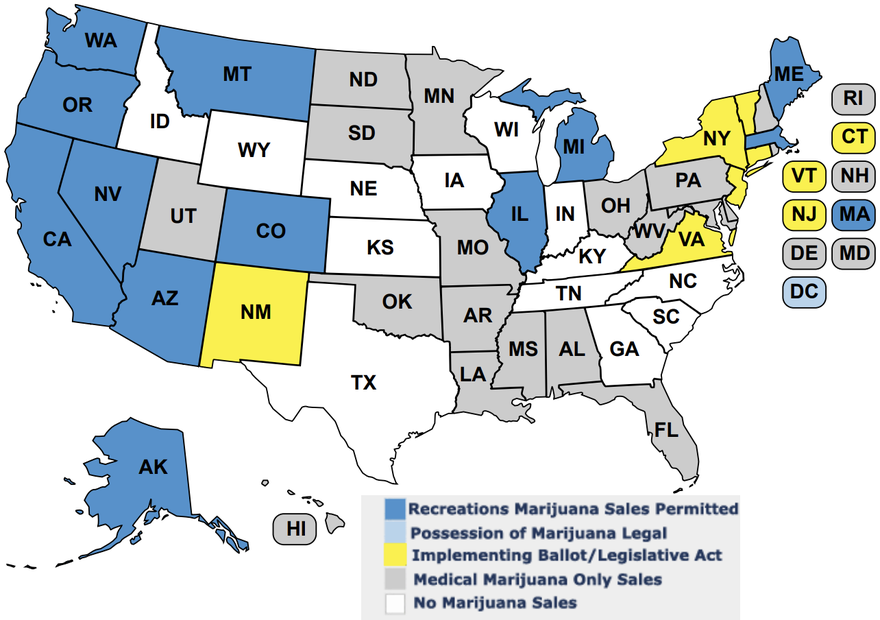

Marijuana Tax Revenue A State By State Breakdown The Motley Fool

California Mortgage Relief Program

How To Get Your California Stimulus Check And Other Tax Credits You Re Entitled To Kqed

If You Have Tax Debt Here Are 5 Tips To Set Things Right With The Irs

Tax Guide For Cannabis Businesses